Case Study:

How Dr. Alice Transformed Her Tax Bill into a

$3M Retirement Nest Egg

The Challenge: High Income, High Taxes, and Limited Savings

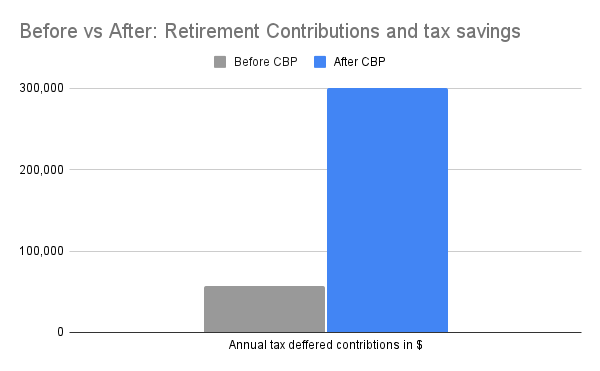

Dr. Alice has been maxing out her 401(k) profit-sharing plan, contributing around $77,500 per year (including catch-up contributions). Over the years, she’s built up about $600,000 in retirement savings—not bad, but not nearly enough given her high earnings and plans for financial security.

With five full-time staff members, she values her employees and provides them with safe harbor 401(k) contributions. But she needs a way to turbocharge her savings while reducing her growing tax burden.

The Solution: A Cash Balance Plan

After consulting with a Third-Party Administrator (TPA) and her CPA, Dr. Alice learns about Cash Balance Plans (CBPs)—a game-changing strategy for high-income professionals like her.

Here’s how her plan is structured:

✔ Dr. Alice contributes $232,000 per year to her CBP

✔ Her staff receives a modest 2–4% pay credit ($3,000–$5,000 per employee)

✔ The plan’s interest credit is set at 5%, ensuring stable growth

✔ Total first-year contribution: $247,000 ($232k for Dr. Alice, ~$15k for staff)

The Immediate Benefits

- $77,500 per year in her 401(k), she’s now putting away over $300,000 annually between both plans.

- Huge tax savings – With her new $300,000+ contribution, she significantly lowers her taxable income, saving about $100,000 per year in federal and state taxes.

- Employee retention – The additional retirement contributions boost staff morale and help her retain top talent.

Fast-Forward 10 Years

By age 60, Dr. Alice’s Cash Balance Plan alone could be worth $2.5–$3 million—on top of her 401(k)!

Her once-modest retirement plan has transformed into a multi-million-dollar safety net, giving her the flexibility to:

✔ Retire comfortably without financial stress

✔ Continue working part-time if she chooses

✔ Leave a lasting financial legacy for her family

Her Only Regret? Not Doing It Sooner.

Looking back, Dr. Alice wishes she had set up the plan a few years earlier, once her income stabilized. She could have saved even more and reduced her taxes even further.

Her story is a perfect example of how even a small practice with a handful of staff can implement a Cash Balance Plan that heavily benefits the business owner—while staying fully compliant with IRS rules.

Disclaimer: This case study is a hypothetical scenario created for illustrative purposes only. While the income figures, tax implications, and retirement strategies discussed have been evaluated for realistic financial accuracy, Dr. Alice is a fictional character and not an actual client. Individual circumstances vary, and this content should not be considered personalized financial, tax, or legal advice. Please consult with a qualified advisor before making any financial decisions.

Consult an Investment Advisor

to assess your specific scenario.