Investment Portfolio Management

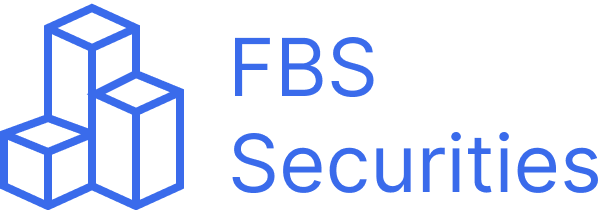

Asset Allocation with Diversified Portfolios

Carefully curated allocations in large-cap holdings, dividend-yielding stocks, fixed-income securities, and sector-specific investments.

Our proprietary “GRO” model strategically combines income-generating assets, growth opportunities, and defensive sectors.

Crystal-clear insights, offering easy-to-understand insights into your portfolio’s performance. This empowers you to make confident, data-driven financial decisions.

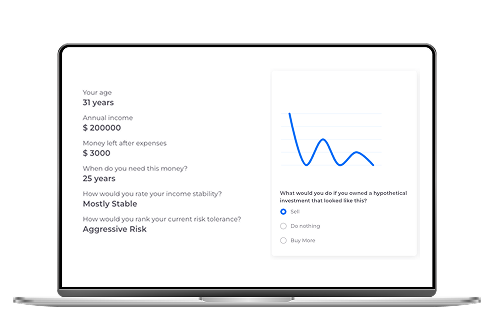

Personalized Risk Assessment

Questionnaire to match your investment to your risk tolerance

Understanding your risk tolerance is the first step toward building a portfolio that fits you. Our detailed risk assessment questionnaire evaluates your financial goals, comfort with market fluctuations, and long-term objectives.

With these insights, we customize your investment plan to reflect your preferences, ensuring you never take on more risk than you’re comfortable with.

Our experts evaluate market trends and your risk appetite to recommend strategies that minimize uncertainty while maximizing potential returns.

Take the Risk assessment to find out where you stand

Asset Under Management (AUM) Fee:

Minimum Investment: $500,000

0 – $2.1 million Investment

1.5%

Recurring annual Fee

Equity management

Portfolio Rebalancing

Tax-loss Harvesting

Fixed income Management

Structured Note management

Free Financial planning

Access to private market

investment planning

10 hours of expert financial advise

more than $2.1 million Investment

1%

Recurring annual Fee

Equity management

Portfolio Rebalancing

Tax-loss Harvesting

Fixed income Management

Structured note management

Free Financial planning

Access to private market

investment planning

10 hours of expert financial advise

AUM fees are calculated and applied separately for each account, even if multiple accounts are held by the same client.

* Please note that these fees are subject to change and may vary based on individual circumstances. We encourage you to contact our team for personalized fee information based on your specific needs and investment goals.